Rental income from an investment property can prove an excellent way to diversify your portfolio and revenue streams. But, like with any investment, you must be aware of your financial obligations. Many new investors will ask, ‘Is rental income taxed?’

The Australian Taxation Office (ATO) taxes any income earned, including rental property income. Any income from your property must be included as part of your total assessable taxable income and declared when you file your income tax return.

Since rental revenue is part of your taxable income, tax deductions are also available to lower your liability. Therefore, you should track all relevant expenses with receipts and other proof to place against your taxable income.

Claim deductions can include:

- Management and maintenance costs

- Borrowing expenses

- Depreciation

- Negative gearing

In this piece, we will explore everything you need to know about how rental income tax works, how to claim tax deductions, how banks assess rental income and more.

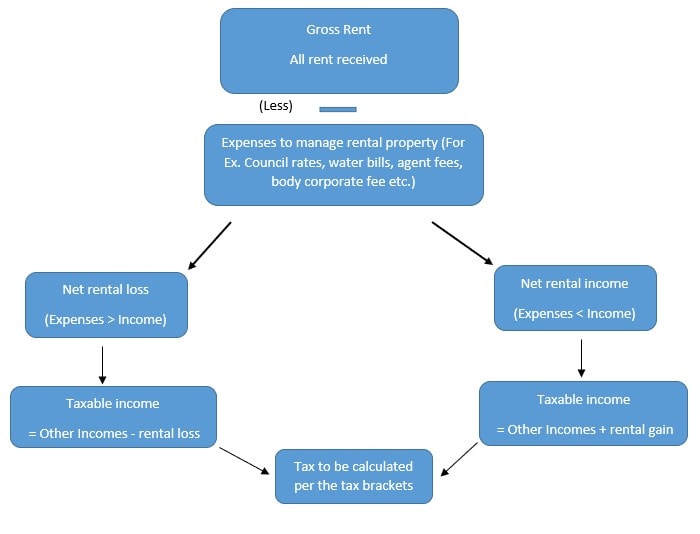

How to Work Out Rental Tax

Your total income, including rental income, is taxed according to the progressive tax system and at your marginal tax rate. This means that the greater your total taxable income for the financial year, the higher you are taxed.

As put forward by the ATO, the marginal tax rates for 2023-2024, depending on your rental income, are:

Taxable income of 0 – $18,200: Nil

Taxable income of $18,201 – $45,000: 19c for each $1 over $18,200

Taxable income of $45,001 – $120,000: $5,092 plus 32.5c for each $1 over $45,000

Taxable income of $120,001 – $180,000: $29,467 plus 37c for each $1 over $120,000

Taxable income of $180,001 and over: $51,667 plus 45c for each $1 over $180,000

Note that the above rates do not include the Medicare levy of 2%.

If your salary before tax is $80,000 per year and you receive $20,000 in rental payments before deductions, your total taxable income is $100,000. In that case, you would have to pay $22,967 to the ATO that financial year.

In addition to this, as of July 2024, tax cuts will change to the following:

reduce the 19 per cent tax rate to 16 per cent

reduce the 32.5 per cent tax rate to 30 per cent

increase the threshold above which the 37 per cent tax rate applies from $120,000 to $135,000

increase the threshold above which the 45 per cent tax rate applies from $180,000 to $190,000.

Simple Example

In Case of Rental Income | In Case of Rental Loss | ||

| Nature | Amount | Nature | Amount |

| Gross Rent | $7,000.00 | Gross Rent | $7,000.00 |

| Less: | Less: | ||

| Council Rates | $1,541.00 | Council Rates | $1,541.00 |

| Water | $200.00 | Water | $200.00 |

| Legal Fees | $1,000.00 | Legal Fees | $1,000.00 |

| Interest | $5,000.00 | ||

| Rental Income | $4,259.00 | Rental Income | -$741.00 |

| Salary Income | $32,000.00 | Salary Income | $32,000.00 |

Taxable Income | Taxable Income | ||

| Salary Income | $32,000.00 | Salary Income | $32,000.00 |

| Add: Rental Income | $4,259.00 | Less: Rental Income | -$741.00 |

| Taxable Income | $36,259.00 | Taxable Income | $31,259.00 |

Tax Payable | Tax Payable | ||

| Up to $18,200 | $0.00 | Up to $18,200 | $0.00 |

| 19% on Balance Amount of $18,059 | $3,431.21 | 19% on Balance Amount of $13,059 | $2,481.21 |

| Total Tax Payable | $3,431.21 | Total Tax Payable | $2,481.21 |

What Qualifies as Rental Property Income Tax Deductions?

Maintaining an investment property and keeping it viable to earn rental income will cost time and money. As such, any rental property expenses you paid for yourself that were made directly for the investment property can be a tax deduction.

For example, you can claim depreciation losses on purchases of any new home items, including:

- Appliances

- Blinds

- Carpets

- Furniture

- Water systems

Management and Maintenance

- advertising,

- bank charges,

- body corporate fees,

- electricity and gas,

- insurance,

- legal expenses,

- agent fees,

- pest control,

- maintenance and repairs, and

- travel expenses for inspection.

Borrowing Expenses

If you have used external finance to secure your investment property, then the expenses related to that can also be deducted against your rental income. These include:

- Interest paid on the investment property’s home loan

- Costs related to home loan refinancing

- Lender’s mortgage insurance

- Mortgage broker fees

Negative Gearing

Suppose the rental income you receive isn’t enough to cover your expenses, and you’re technically losing money on your investment property. In that case, this loss can be subtracted from your taxable income, lowering the amount of tax you will need to pay.

How Do Banks Assess Gross Rental Income?

Many people think that because their rental income covers the interest repayments of their investment loan on paper (interest-only repayments), the bank will lend them more money. The property is positively geared, after all. But this is generally not the case.

Lenders and banks receive many loan proposals from property investors daily and need to manage and hedge their risks. One way to assess these loan proposals is to employ a practice known as income shading.

Income Shading

Income shading is a practice that lenders or banks use to assess and mitigate the risks attached to potential renters. They don’t look at a person’s numbers and figures at face value but assess an “effective” or adjusted set of quantities.

Banks take additional shading of your rental property income and apply a higher assessment rate to your repayments based on the remaining term of your principal and interest period. So, if your loan is approved at 30 years with five years interest only, banks will calculate your repayments over 25 years, principal and interest.

It doesn’t stop there, either. Banks can apply up to 2.5% on top of your actual rate for assessment. So, if your rate is actually 3%, they will assess it based on 5.5%.

Examples:

Here is an example of how banks assess investment properties. A loan structured like this (positively geared) is great.

| Current | |||

| Loan | Rate | Structure | Repay – PM |

| $500,000 | 3% | 5Y – IO | $1,250 |

| Income | |||

| Rental – PM | Fees | Rates + Insurance | Net Balance |

| $1,950 | 8% | $300 PM | $4,494 |

| Positive | $244 |

As mentioned, how the banks assess your loan is quite different. While your investment is positively geared on paper, when the bank considers it, you’re now $812 negative per month, as indicated below.

| Bank Assessment | |||

| Loan | Rate | Structure | Repay – PM |

| $500,000 | 3% | 25Y – P&I | $2,372 |

| Income | |||

| Rental – PM | Bank Use 80% | Net Balance | |

| $1,950 | $1,560 | $1,560 | |

| Negative | -$812 | ||

So, the next question is, what rental property income is needed for the bank to see investment properties as neutrally geared? $2,968.33 per month is required if your loan is at five years interest only, which is a 7.12% yield to loan.

Therefore, your serviceability is not affected by having this investment property.

| Bank Assessment | |||

| Loan | Rate | Structure | Repay – PM |

| $500,000 | 3% | 25Y – P&I | $2,372 |

| Income | |||

| Rental – PM | Bank Use 80% | Net Balance | |

| $2,968.33 | $2,374.67 | $2,374.67 | |

| Positive | $2.67 | ||

| Yield to Loan | 7.12% | ||

Key Takeaways

Understanding tax pertaining to rental property income and expenses isn’t always easy. But correctly deducting certain costs can save you hundreds of dollars or more every year.

Your total assessable income is taxed according to marginal tax rates, so the greater your total taxable income, the more you get taxed.

Just remember any expenses that you paid for yourself made directly for the investment property can be tax-deductible, such as:

- Management and maintenance

- Borrowing expenses

- Capital gains tax

- Negative gearing

Banks assess rental property income by applying a higher assessment rate to repayments based on the remaining term of your principal and interest period. This means that the bank might not lend you more money even if your property is positively geared on paper.

At the end of the day, the biggest investment you can make is employing the skills of a mortgage broker to guide you through this process.

Contact The Mortgage Agency today to seek professional advice and get started.

Disclaimer:

Please note that every effort has been made to ensure that the information provided in this guide is accurate. You should note, however, that the information is intended as a guide only, providing an overview of general information available to property buyers and investors. This guide is not intended to be an exhaustive source of information and should not be seen to constitute legal, tax or investment advice. You should, where necessary, seek your own advice for any legal, tax or investment issues raised in your affairs.